Meet “Teddy” an AI agent to assist customers when selecting a credit card

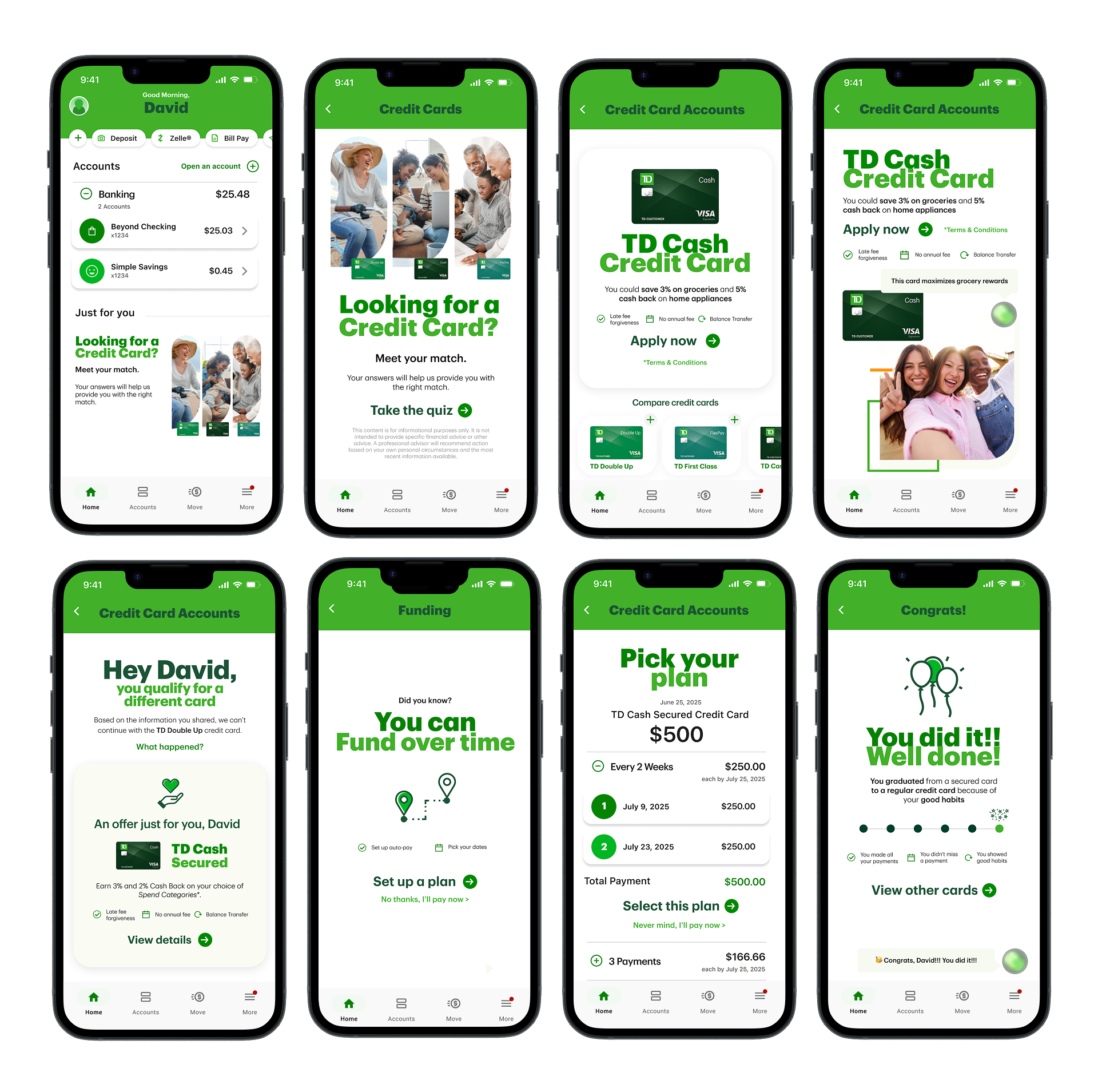

TD Bank (U.S.), Mobile App

TEAM

Lead Product Designer

3 Associate Designers

1 Design Researcher

ROLE

Lead Product & UI Designer

FOCUS

Credit card comparison, product selection, onboarding

Challenge

For over six months, TD Bank’s credit card sales had been steadily declining (applications down 16.9% YOY), with fall-off points across the application journey and no clear understanding of why.

This 3-month all-hands-on-deck project was designed to take a holistic look at the digital credit card business—from marketing to the website and mobile app to account funding—to uncover the root causes and improve digital acquisition and sales.

We were asked to look at:

Immediate fixes/short-term adjustments to the existing flow, and

Long-term North Star Vision strategy to push us ahead for the future

At TD, many digital experiences are traditionally bank-focused, prioritizing internal structures over user needs.

I led a cross-functional team to reimagine the future state of the credit card shopping and onboarding experience across TD.com and the mobile app.

Through a Design Thinking workshop I facilitated, we identified core pain points in the current journey:

High abandonment within the first three screens of the credit card application

Lack of personalized support or confidence when choosing a product

User testing showed that product comparisons were confusing, especially for younger or first-time applicants

No in-the-moment help when customers ran into errors or friction within the application

Solution: “Teddy” - an AI -Powered Digital Assistant

We created Teddy, an intelligent support agent designed to meet customers where they are — proactively stepping in at key moments to offer:

Real-time, context-aware support (e.g. form help, eligibility explanations)

Tailored product recommendations based on user preferences

Financial literacy tips, particularly for Gen Z and first-time cardholders

Conversational UI modeled on helpful, empathetic tone to build trust

We pitched Teddy using research-backed, persona-based storytelling centered on a mother and her 18-year-old son, showing how the same tool could flex to support users at very different life stages.

Some screens I designed to stretch the current boundaries of our mobile app UI, drawing on design research from td.com on how users want to compare products on desktop and mobile.

My Role & Contributions

I led the Design Thinking workshop to define the opportunity space and align on user-first goals

Worked cross-functionally across web and mobile teams, including TD.com (shopping), mobile app (marketing/product), and application/onboarding

Co-created narrative to illustrate concepts to influence executive leadership

Collaborated with content design, accessibility, and engaged research to ensure Teddy’s voice is inclusive, empathetic, and trustworthy

Designed with the intent to expand the existing design system, while pushing new patterns for AI and conversational flows

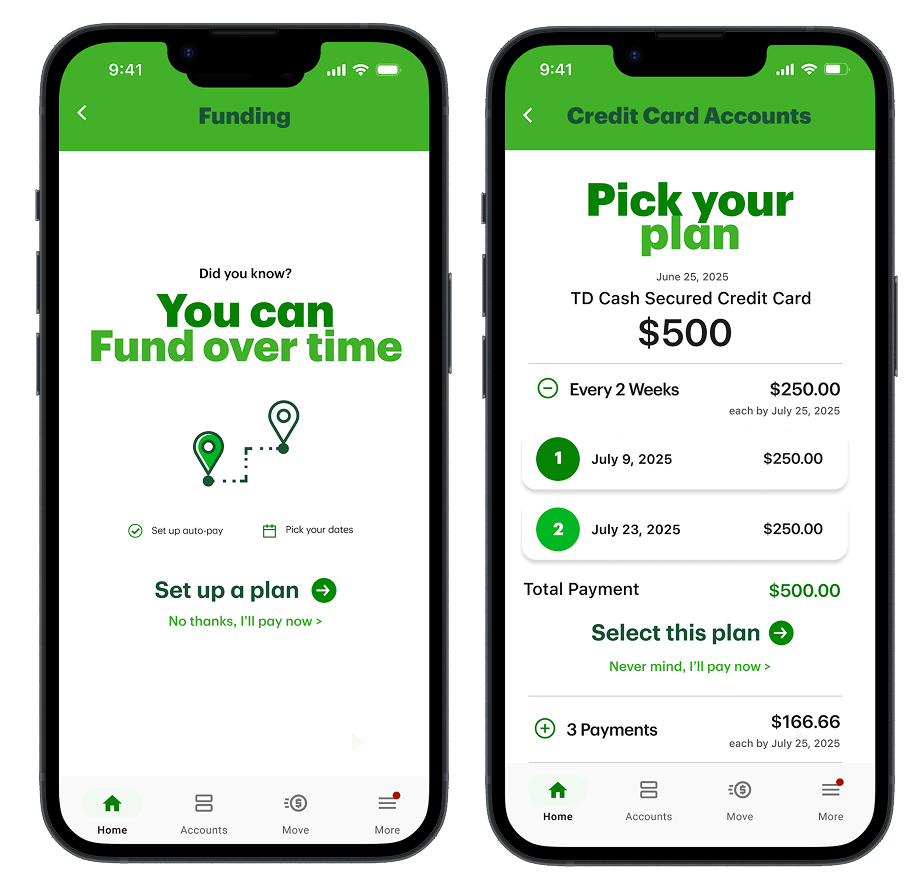

A new feature I proposed: the ability to fund your account in increments, which is different than how TD allows customers to fund Secure Credit Card accounts today. I drew inspiration from other financial institutions like Affirm and Chase’s “pay-over-time” credit card feature.

Cross-Platform Impact

This project became a model for cross-platform collaboration, with teams across:

TD.com (the “shopping” experience)

Mobile app (marketing offers and product comparison)

Application/onboarding

Engineering and product

Together, we aligned on a shared vision for how AI could enhance customer confidence and reduce friction, regardless of platform.

The design team uses FigJam to collaborate on designs and presentations as well as run Design Thinking workshops and collect feedback from stakeholders.

Outcomes

We secured leadership buy-in for the FY26 roadmap for user testing and technical scoping. User research is in flight to understand the impact of the AI agent within the customer flow. This main project concluded in July of 2025, so we will be measuring outcomes as we begin to implement the incremental enhancements to the user flows.

Teddy is now influencing other initiatives across the bank tied to AI-driven banking assistance

Sparked new interest in building personalized, user-centered journeys grounded in real human needs instead of bank structures